Dollars and Sense

William Poole*

President, Federal Reserve Bank of St. Louis

Financial Planning Association of Missouri and Southern Illinois

St. Louis

Jan. 9, 2008

*I appreciate assistance and comments provided by my colleagues at the Federal Reserve Bank of St. Louis. Joseph C. Elstner, Public Affairs officer, provided special assistance. Robert Rasche, senior vice president and director of Research, and Robert Schenk, senior vice president for Public and Community Affairs, provided valuable input to an earlier draft of the speech. However, I take full responsibility for errors. The views expressed are mine and do not necessarily reflect official positions of the Federal Reserve System.

Dollars and Sense

We are certainly living in extraordinary financial times. Our nation has enjoyed a long economic expansion and inflation has been relatively low. However, since last August, financial markets have been in considerable turmoil resulting from subprime mortgage lending and a deflating housing boom. The Federal Open Market Committee (FOMC) is watching both recession and inflation risks. Recession risks are primarily a consequence of financial turmoil, which has threatened to spread housing industry woes to the broader economy.

Will housing sector problems push the economy into recession? It is too early to tell right now, but what we can do is to examine the current situation closely and try to learn from it. Perhaps “relearn” is a better word, because the mistakes that brought us to this point have been made before. There are no new lessons here. The lessons are familiar ones that need to be more forcefully driven home and incorporated in standard financial practice in the future. That is why I’ve titled my remarks “Dollars and Sense.” The Fed is working on providing the public with better and more useful financial information that we hope will reduce the odds on the housing finance industry repeating its recent financial mistakes.

My plan is to review the current situation and examine five key mistakes by borrowers and other market players. Although many borrowers have little financial expertise, we would have expected all the other players to be more sophisticated and experienced. Then I’ll review where the country stands in trying to educate Americans in basic financial literacy and economic thinking. As part of that review, I’ll include some of the things the Federal Reserve is doing to address this issue. Finally, I’ll look at what we can all do to help Americans know more about their finances and to give them the tools to make better choices. As financial planners, you of course have a large stake in this enterprise and will benefit in the long run from having better-prepared clients. I know your organization is already involved in some education efforts, and I applaud your efforts.

Before proceeding, I want to emphasize that the views I express here are mine and do not necessarily reflect official positions of the Federal Reserve System. I thank my colleagues at the Federal Reserve Bank of St. Louis for their comments. Joseph C. Elstner, Public Affairs officer at the St. Louis Fed, provided special assistance. However, I retain full responsibility for errors.

Five Mistakes

Let’s review the five major mistakes creating the subprime mess.

First, too many borrowers took on mortgages they could not afford. Nothing new there, except for the number of such borrowers. How could something seemingly so preventable happen? One of the main culprits was the adjustable rate mortgage, or ARM. Actually, the problem is not the ARM itself but grossly inadequate borrower understanding of this type of mortgage. The “Two/Twenty-Eight” ARM called for low initial payments for two years, which would then reset to higher levels for the remaining 28 years of the 30-year mortgage. Too many borrowers, though, did not insist on knowing just what the “higher level” would mean, and too many mortgage brokers did not provide that information in a way the borrower could understand. Other borrowers, wanting to take advantage of low initial payments, gave misleading or false information about their ability to repay. It is important to emphasize that there is nothing inherently wrong with adjustable rate mortgages, and they make sense for many borrowers. However, borrowers must be prepared for interest rate resets and able to pay higher rates. In recent years, too many borrowers were not prepared. Borrowers also need to understand prepayment penalties in their mortgage contracts. These can make refinancing ARMs into fixed-rate mortgages terribly expensive.

Second in our mistakes summary, mortgage brokers put too many borrowers into unsuitable mortgages. As I mentioned in a speech to a St. Louis real estate group last July, with widely held expectations of rising interest rates priced into the markets throughout the 2003-2005 period, it is difficult to avoid the judgment that these ARM loans were poorly underwritten. It was imprudent for mortgage bankers and lenders to approve borrowers who likely could not service the loans when rates rose. It is important to understand that rising interest rates were not just a risk but actually the market expectation. Poor underwriting not only jeopardized the borrowers put into unsuitable mortgages but also the brokers themselves. Numerous brokers are now bankrupt, and many survivors have suffered large losses and sullied reputations.

Third, it is surprising to me that investment banks jeopardized their reputations by securitizing these mortgages when the underlying loans were backed by inadequate or spurious information.

Damaged reputations are also casualties of the fourth major mistake: rating agencies that placed AAA ratings on many securities backed by subprime mortgages. The rating agencies seemed to have based their ratings on a backward look at default experience on similar mortgages before 2006, rather than on a forward look based on careful analysis of the likely ability of borrowers to repay in less favorable market circumstances. The reason default experience on subprime mortgages was relatively favorable before 2007 is that housing prices were rising, permitting stressed borrowers to sell their properties to repay the mortgages. The rating agencies, apparently, did not believe that house prices might stop rising, in which case the music would stop.

The final entry on our major mistake list is investors who bought those securities without conducting an adequate analysis of the underlying investments. Investors too readily accepted the AAA ratings at face value. As financial planners, you are very familiar with the cliché that “if something looks too good to be true, it probably is.” A reach for yield with inadequate attention to risk is another basic lesson that apparently cannot be relearned often enough.

It is interesting, and a bit depressing, that investment professionals made four of the five mistakes. I can understand the mistakes many financially naïve borrowers made but have a hard time understanding how so many investment professionals could have been so wrong. Many observers point to greed, but I prefer a different explanation. Shortsightedness rather than greed explains actions that led to losses of tens of billions of dollars and the failure of many financial firms.

Avoiding Future Mistakes

I will now to add some detail to three of these mistake categories—borrowers who cannot repay, mortgage brokers putting people into unsuitable loans and investors who did not do their homework. Here is my question: How could better education and financial decision-making have helped people avoid these mistakes?

Borrowers. Too many know too little about credit and what its costs and risks are. Starting with coursework on credit usage in elementary and middle schools and continuing with financial literacy and economics in high school would go a long way toward equipping borrowers with the information they need, or at least give them enough knowledge to ask the right questions about what they can afford and what lending terms mean.

Mortgage brokers. Many have closed their doors and gone out of business through unsatisfactory lending. In the July realtor speech I mentioned earlier, I emphasized that a durable stream of profits in mortgage lending requires a continuing flow of capital from investors willing to buy the mortgages an originator wants to sell and securitize. Given the difficulty any mortgage broker faces in differentiating its own products, the best way to stand out and survive over the long term is to give outstanding service to mortgage shoppers. Turning outstanding service into future business prospects is precisely the role for reputation. A firm’s good name spread through word of mouth will pay the highest dividends over the long term. And going the extra mile by making certain that borrowers understand lending terms and are able to service those loans can cement that reputation and keep those doors open a long time.

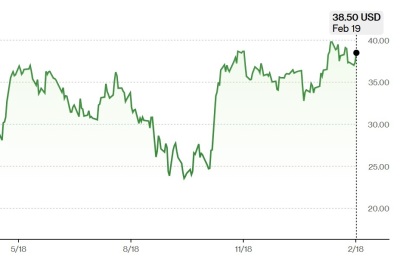

Investors. Here I want to look at individual investors, the ones you know so well. It may be true that many if not most such investors put their money heavily into mutual funds, reducing some of the risk of holding individual stocks and bonds. What would help them greatly, I believe, is a much better understanding of what their funds hold. Mutual funds are professionally managed, but the subprime fallout has hit the pros hard, too. In one example from our Federal Reserve District, two investors in two Regions Morgan Keegan mutual funds severely affected by subprime mortgage problems are suing over sharp declines in the values of their investments. As of Dec. 13, 2007, the Select Intermediate Bond Fund and the Select High Income Fund were down 47 and 56 percent, respectively. News media accounts tell of disastrous results being faced by other investors in similar types of securities. Would investors equipped with better knowledge have avoided such steep losses? More organizations should get behind efforts to improve investor knowledge.

Where does the country stand in terms of educating our citizens in the financial and economic basics? The brief answer is that efforts across the nation are making progress but we have a long way to go.

According to a 2007 survey by the National Council on Economic Education:

* Economics, traditionally part of the Social Studies curriculum, is now included in the educational standards of all states.

* 41 states, up from 28 in 1998, now require these standards be implemented. Sounds good so far, but there’s more.

* Only 17 states, not including Missouri or Illinois, require students to take an economics course for high school graduation, up from 13 states in 1998.

* Only 22 states, not including Missouri or Illinois, require testing of student knowledge in economics, three fewer than in 2004.

Personal finance,a newer subject in comparison with economics, is now included in the educational standards of 40 states, up from 21 in 1998, with 28 states requiring these standards to be implemented. Still, though, only seven states require students to take a personal finance course for high school graduation and only nine require the testing of knowledge in personal finance. Missouri now requires personal finance for graduation and tests for knowledge; Illinois requires a consumer education course but does not test on the subject for graduation.

What we have, then, is a mixed bag when it comes to preparing students to learn about money and the choices to be made in handling it. Our nation is making progress, but as we have seen with the subprime mess, we as a society have a lot more to do in equipping students and adults with the knowledge they need to make wiser financial decisions.

I know the Financial Planning Association of Missouri and Southern Illinois believes in boosting financial literacy. Your web site tells of the projects you’ve undertaken to better educate yourselves and your clients and the volunteer work you’ve done for the community. At the Federal Reserve Bank of St. Louis, and in our branch cities of Little Rock, Louisville and Memphis, we’re trying to do our part, too.

We’ve got a two-pronged effort going, with one part aimed at community development and a complementary effort aimed at improving financial education in the schools. On the community development side, we work on educating community groups and through those groups, their members, about improving communities through making better financial decisions.

Last month, for example, we hosted a seminar, “HMDA to Home Improvement,” in St. Louis. HMDA is the acronym for Home Mortgage Disclosure Act. Attending were mortgage lending experts, community group representatives, economists and government officials. Discussions were aimed at helping homeowners avoid foreclosures and take advantage of programs making home improvements affordable.

The St. Louis Fed also participates in the St. Louis Foreclosure Intervention Task Force. It’s a collaboration of representatives of government, financial institutions, and real estate and nonprofit organizations One outgrowth of that effort is a hotline, 888-995-HOPE, that counsels homeowners concerned about foreclosure. Brochures and television appearances helped promote the hotline. We helped in starting a similar program in Springfield, Mo.

In Louisville, Ky., our branch staff is involved in the Don’t Borrow Trouble Coalition, an organization helping citizens deal with lending issues, particularly as they relate to mortgages. The Kentucky Predatory Lending Prevention Committee is another organization we help support; it helps families avoid money scams and to resolve financial problems. We’re also active in similar efforts in Arkansas, Indiana, Tennessee and other locations.

Besides our community development efforts, the St. Louis Fed and other Federal Reserve banks work through state economic education councils, centers for economic education and local school districts to offer mostly free economic and financial education materials and curricula to teachers. We do some work directly with students, but we find we can reach many more of them by working through their teachers. Our aim is to drop large boulders in the education pond and to encourage the ripples to expand.

We have a lot going on in this area too; I’ll highlight some of the key projects.

I mentioned earlier that Missouri now requires a one-semester personal finance course. The St. Louis Fed’s economic education experts are helping to train educators who will be teaching those courses, setting up workshops for them and training teachers in the new curriculum.

We also take part, as do representatives from commercial banks, in Teach Children to Save Day, an annual event for first- through third-graders. In the St. Louis metro area alone, our volunteer employees taught lessons in over 400 classrooms last year on the importance of saving regularly and what it means to save over the long term for something you really want.

There are many places teachers can go to for useful information and classroom-ready lessons on money, credit and economic concepts. Two of the best are web sites: first, our Bank’s web site at www.stlouisfed.org. Clicking on the “education” link brings teachers to conferences, materials, lessons, teaching tips and much more. The other site is actually a portal at www.federalreserveeducation.org. It’s an entry to web sites providing help of all kinds for teachers of personal finance and economics. Just about any topic under the general “economics and personal finance” heading is included in one or both web sites, along with support materials and tips on using them.

In St. Louis and our branch cities of Little Rock, Louisville and Memphis, our economic education staff in 2007 conducted well over 100 separate meetings, workshops, competitions or other events aimed at equipping teachers to provide their kindergarten through high school students with the skills they need to deal with money, debt, credit, saving and economic decision-making.

For example, in early 2007, high school teachers in Southhaven, Miss., attended a "Growing Smart with Money" workshop led by our Memphis Branch economic education staff. In the St. Louis metro area, we worked with local libraries to put on a program for middle schoolers called “Money Smarts for Kids.” We worked with the Kansas City Fed and centers for economic education staff at Missouri universities to conduct the first-ever Missouri Personal Finance Competition in St. Louis, Kansas City, Springfield and Columbia, with the championship held in Jefferson City. A program begun by our Little Rock Branch staff, the Piggy Bank Primer, has helped early grade school students throughout our District to learn more about saving. A program we helped roll out in Quincy, Ill., “Your Paycheck” is expanding in our District. It’s aimed at teenagers, particular those holding their first jobs, and teaches them about paychecks—what the various deductions mean and how you can learn more about benefits, saving, withholding and more.

That’s just a partial listing of the community development and economic and financial education efforts we’ve got going. And there’s more of that coming for 2008 and beyond.

What can we all do to move this trend along, to put learning the basics of saving, borrowing and credit higher in the public’s mind? There are a number of things, and it is going to take the Federal Reserve, the Financial Planning Association of Missouri and Southern Illinois, and thousands of other organizations to pull it off.

* Contact your local schools and ask them where learning about saving, spending, investing and borrowing fit into their curricula, what lessons are being taught and how. Bring up this subject at school board meetings and parent meetings.

* Support legislative efforts to require coursework in economics and personal finance for high school graduation. Let your state representatives and senators know through calls, letters or e-mails and personal contact.

* Write op-ed pieces highlighting the need for expanded financial education and offer them to local news media. Don’t overlook influential Internet bloggers…they can help spread the word quickly.

* Get behind or start financial and economic education programs in professional organizations and lend your skills. We ask a lot of our educators; they can do a lot, but they can’t do it all. We can all add our voices…and ourselves.

Concluding Comment

The current financial turmoil will take awhile to play itself out. The fundamentals of our economy remain strong, however, and 2008 looks to be a year of rising growth. Economic forecasters expect slow expansion in the first half of the year and a quickening pace in the second half. Meanwhile, if borrowers, lenders and investors can refocus on financial basics and re-emphasize critical lessons about credit and risk, the financial future can be brighter than the second half of 2007. For that brighter future, we need to infuse our education at all levels with the lessons of 2007—old lessons to be sure but easy to understand at a very practical level from 2007 experience. With continuing effort we can expect that financial upsets such as the current one will be infrequent and milder when they do occur.

Thank you and I’d be glad to take your questions.

William Poole*

President, Federal Reserve Bank of St. Louis

Financial Planning Association of Missouri and Southern Illinois

St. Louis

Jan. 9, 2008

*I appreciate assistance and comments provided by my colleagues at the Federal Reserve Bank of St. Louis. Joseph C. Elstner, Public Affairs officer, provided special assistance. Robert Rasche, senior vice president and director of Research, and Robert Schenk, senior vice president for Public and Community Affairs, provided valuable input to an earlier draft of the speech. However, I take full responsibility for errors. The views expressed are mine and do not necessarily reflect official positions of the Federal Reserve System.

Dollars and Sense

We are certainly living in extraordinary financial times. Our nation has enjoyed a long economic expansion and inflation has been relatively low. However, since last August, financial markets have been in considerable turmoil resulting from subprime mortgage lending and a deflating housing boom. The Federal Open Market Committee (FOMC) is watching both recession and inflation risks. Recession risks are primarily a consequence of financial turmoil, which has threatened to spread housing industry woes to the broader economy.

Will housing sector problems push the economy into recession? It is too early to tell right now, but what we can do is to examine the current situation closely and try to learn from it. Perhaps “relearn” is a better word, because the mistakes that brought us to this point have been made before. There are no new lessons here. The lessons are familiar ones that need to be more forcefully driven home and incorporated in standard financial practice in the future. That is why I’ve titled my remarks “Dollars and Sense.” The Fed is working on providing the public with better and more useful financial information that we hope will reduce the odds on the housing finance industry repeating its recent financial mistakes.

My plan is to review the current situation and examine five key mistakes by borrowers and other market players. Although many borrowers have little financial expertise, we would have expected all the other players to be more sophisticated and experienced. Then I’ll review where the country stands in trying to educate Americans in basic financial literacy and economic thinking. As part of that review, I’ll include some of the things the Federal Reserve is doing to address this issue. Finally, I’ll look at what we can all do to help Americans know more about their finances and to give them the tools to make better choices. As financial planners, you of course have a large stake in this enterprise and will benefit in the long run from having better-prepared clients. I know your organization is already involved in some education efforts, and I applaud your efforts.

Before proceeding, I want to emphasize that the views I express here are mine and do not necessarily reflect official positions of the Federal Reserve System. I thank my colleagues at the Federal Reserve Bank of St. Louis for their comments. Joseph C. Elstner, Public Affairs officer at the St. Louis Fed, provided special assistance. However, I retain full responsibility for errors.

Five Mistakes

Let’s review the five major mistakes creating the subprime mess.

First, too many borrowers took on mortgages they could not afford. Nothing new there, except for the number of such borrowers. How could something seemingly so preventable happen? One of the main culprits was the adjustable rate mortgage, or ARM. Actually, the problem is not the ARM itself but grossly inadequate borrower understanding of this type of mortgage. The “Two/Twenty-Eight” ARM called for low initial payments for two years, which would then reset to higher levels for the remaining 28 years of the 30-year mortgage. Too many borrowers, though, did not insist on knowing just what the “higher level” would mean, and too many mortgage brokers did not provide that information in a way the borrower could understand. Other borrowers, wanting to take advantage of low initial payments, gave misleading or false information about their ability to repay. It is important to emphasize that there is nothing inherently wrong with adjustable rate mortgages, and they make sense for many borrowers. However, borrowers must be prepared for interest rate resets and able to pay higher rates. In recent years, too many borrowers were not prepared. Borrowers also need to understand prepayment penalties in their mortgage contracts. These can make refinancing ARMs into fixed-rate mortgages terribly expensive.

Second in our mistakes summary, mortgage brokers put too many borrowers into unsuitable mortgages. As I mentioned in a speech to a St. Louis real estate group last July, with widely held expectations of rising interest rates priced into the markets throughout the 2003-2005 period, it is difficult to avoid the judgment that these ARM loans were poorly underwritten. It was imprudent for mortgage bankers and lenders to approve borrowers who likely could not service the loans when rates rose. It is important to understand that rising interest rates were not just a risk but actually the market expectation. Poor underwriting not only jeopardized the borrowers put into unsuitable mortgages but also the brokers themselves. Numerous brokers are now bankrupt, and many survivors have suffered large losses and sullied reputations.

Third, it is surprising to me that investment banks jeopardized their reputations by securitizing these mortgages when the underlying loans were backed by inadequate or spurious information.

Damaged reputations are also casualties of the fourth major mistake: rating agencies that placed AAA ratings on many securities backed by subprime mortgages. The rating agencies seemed to have based their ratings on a backward look at default experience on similar mortgages before 2006, rather than on a forward look based on careful analysis of the likely ability of borrowers to repay in less favorable market circumstances. The reason default experience on subprime mortgages was relatively favorable before 2007 is that housing prices were rising, permitting stressed borrowers to sell their properties to repay the mortgages. The rating agencies, apparently, did not believe that house prices might stop rising, in which case the music would stop.

The final entry on our major mistake list is investors who bought those securities without conducting an adequate analysis of the underlying investments. Investors too readily accepted the AAA ratings at face value. As financial planners, you are very familiar with the cliché that “if something looks too good to be true, it probably is.” A reach for yield with inadequate attention to risk is another basic lesson that apparently cannot be relearned often enough.

It is interesting, and a bit depressing, that investment professionals made four of the five mistakes. I can understand the mistakes many financially naïve borrowers made but have a hard time understanding how so many investment professionals could have been so wrong. Many observers point to greed, but I prefer a different explanation. Shortsightedness rather than greed explains actions that led to losses of tens of billions of dollars and the failure of many financial firms.

Avoiding Future Mistakes

I will now to add some detail to three of these mistake categories—borrowers who cannot repay, mortgage brokers putting people into unsuitable loans and investors who did not do their homework. Here is my question: How could better education and financial decision-making have helped people avoid these mistakes?

Borrowers. Too many know too little about credit and what its costs and risks are. Starting with coursework on credit usage in elementary and middle schools and continuing with financial literacy and economics in high school would go a long way toward equipping borrowers with the information they need, or at least give them enough knowledge to ask the right questions about what they can afford and what lending terms mean.

Mortgage brokers. Many have closed their doors and gone out of business through unsatisfactory lending. In the July realtor speech I mentioned earlier, I emphasized that a durable stream of profits in mortgage lending requires a continuing flow of capital from investors willing to buy the mortgages an originator wants to sell and securitize. Given the difficulty any mortgage broker faces in differentiating its own products, the best way to stand out and survive over the long term is to give outstanding service to mortgage shoppers. Turning outstanding service into future business prospects is precisely the role for reputation. A firm’s good name spread through word of mouth will pay the highest dividends over the long term. And going the extra mile by making certain that borrowers understand lending terms and are able to service those loans can cement that reputation and keep those doors open a long time.

Investors. Here I want to look at individual investors, the ones you know so well. It may be true that many if not most such investors put their money heavily into mutual funds, reducing some of the risk of holding individual stocks and bonds. What would help them greatly, I believe, is a much better understanding of what their funds hold. Mutual funds are professionally managed, but the subprime fallout has hit the pros hard, too. In one example from our Federal Reserve District, two investors in two Regions Morgan Keegan mutual funds severely affected by subprime mortgage problems are suing over sharp declines in the values of their investments. As of Dec. 13, 2007, the Select Intermediate Bond Fund and the Select High Income Fund were down 47 and 56 percent, respectively. News media accounts tell of disastrous results being faced by other investors in similar types of securities. Would investors equipped with better knowledge have avoided such steep losses? More organizations should get behind efforts to improve investor knowledge.

Where does the country stand in terms of educating our citizens in the financial and economic basics? The brief answer is that efforts across the nation are making progress but we have a long way to go.

According to a 2007 survey by the National Council on Economic Education:

* Economics, traditionally part of the Social Studies curriculum, is now included in the educational standards of all states.

* 41 states, up from 28 in 1998, now require these standards be implemented. Sounds good so far, but there’s more.

* Only 17 states, not including Missouri or Illinois, require students to take an economics course for high school graduation, up from 13 states in 1998.

* Only 22 states, not including Missouri or Illinois, require testing of student knowledge in economics, three fewer than in 2004.

Personal finance,a newer subject in comparison with economics, is now included in the educational standards of 40 states, up from 21 in 1998, with 28 states requiring these standards to be implemented. Still, though, only seven states require students to take a personal finance course for high school graduation and only nine require the testing of knowledge in personal finance. Missouri now requires personal finance for graduation and tests for knowledge; Illinois requires a consumer education course but does not test on the subject for graduation.

What we have, then, is a mixed bag when it comes to preparing students to learn about money and the choices to be made in handling it. Our nation is making progress, but as we have seen with the subprime mess, we as a society have a lot more to do in equipping students and adults with the knowledge they need to make wiser financial decisions.

I know the Financial Planning Association of Missouri and Southern Illinois believes in boosting financial literacy. Your web site tells of the projects you’ve undertaken to better educate yourselves and your clients and the volunteer work you’ve done for the community. At the Federal Reserve Bank of St. Louis, and in our branch cities of Little Rock, Louisville and Memphis, we’re trying to do our part, too.

We’ve got a two-pronged effort going, with one part aimed at community development and a complementary effort aimed at improving financial education in the schools. On the community development side, we work on educating community groups and through those groups, their members, about improving communities through making better financial decisions.

Last month, for example, we hosted a seminar, “HMDA to Home Improvement,” in St. Louis. HMDA is the acronym for Home Mortgage Disclosure Act. Attending were mortgage lending experts, community group representatives, economists and government officials. Discussions were aimed at helping homeowners avoid foreclosures and take advantage of programs making home improvements affordable.

The St. Louis Fed also participates in the St. Louis Foreclosure Intervention Task Force. It’s a collaboration of representatives of government, financial institutions, and real estate and nonprofit organizations One outgrowth of that effort is a hotline, 888-995-HOPE, that counsels homeowners concerned about foreclosure. Brochures and television appearances helped promote the hotline. We helped in starting a similar program in Springfield, Mo.

In Louisville, Ky., our branch staff is involved in the Don’t Borrow Trouble Coalition, an organization helping citizens deal with lending issues, particularly as they relate to mortgages. The Kentucky Predatory Lending Prevention Committee is another organization we help support; it helps families avoid money scams and to resolve financial problems. We’re also active in similar efforts in Arkansas, Indiana, Tennessee and other locations.

Besides our community development efforts, the St. Louis Fed and other Federal Reserve banks work through state economic education councils, centers for economic education and local school districts to offer mostly free economic and financial education materials and curricula to teachers. We do some work directly with students, but we find we can reach many more of them by working through their teachers. Our aim is to drop large boulders in the education pond and to encourage the ripples to expand.

We have a lot going on in this area too; I’ll highlight some of the key projects.

I mentioned earlier that Missouri now requires a one-semester personal finance course. The St. Louis Fed’s economic education experts are helping to train educators who will be teaching those courses, setting up workshops for them and training teachers in the new curriculum.

We also take part, as do representatives from commercial banks, in Teach Children to Save Day, an annual event for first- through third-graders. In the St. Louis metro area alone, our volunteer employees taught lessons in over 400 classrooms last year on the importance of saving regularly and what it means to save over the long term for something you really want.

There are many places teachers can go to for useful information and classroom-ready lessons on money, credit and economic concepts. Two of the best are web sites: first, our Bank’s web site at www.stlouisfed.org. Clicking on the “education” link brings teachers to conferences, materials, lessons, teaching tips and much more. The other site is actually a portal at www.federalreserveeducation.org. It’s an entry to web sites providing help of all kinds for teachers of personal finance and economics. Just about any topic under the general “economics and personal finance” heading is included in one or both web sites, along with support materials and tips on using them.

In St. Louis and our branch cities of Little Rock, Louisville and Memphis, our economic education staff in 2007 conducted well over 100 separate meetings, workshops, competitions or other events aimed at equipping teachers to provide their kindergarten through high school students with the skills they need to deal with money, debt, credit, saving and economic decision-making.

For example, in early 2007, high school teachers in Southhaven, Miss., attended a "Growing Smart with Money" workshop led by our Memphis Branch economic education staff. In the St. Louis metro area, we worked with local libraries to put on a program for middle schoolers called “Money Smarts for Kids.” We worked with the Kansas City Fed and centers for economic education staff at Missouri universities to conduct the first-ever Missouri Personal Finance Competition in St. Louis, Kansas City, Springfield and Columbia, with the championship held in Jefferson City. A program begun by our Little Rock Branch staff, the Piggy Bank Primer, has helped early grade school students throughout our District to learn more about saving. A program we helped roll out in Quincy, Ill., “Your Paycheck” is expanding in our District. It’s aimed at teenagers, particular those holding their first jobs, and teaches them about paychecks—what the various deductions mean and how you can learn more about benefits, saving, withholding and more.

That’s just a partial listing of the community development and economic and financial education efforts we’ve got going. And there’s more of that coming for 2008 and beyond.

What can we all do to move this trend along, to put learning the basics of saving, borrowing and credit higher in the public’s mind? There are a number of things, and it is going to take the Federal Reserve, the Financial Planning Association of Missouri and Southern Illinois, and thousands of other organizations to pull it off.

* Contact your local schools and ask them where learning about saving, spending, investing and borrowing fit into their curricula, what lessons are being taught and how. Bring up this subject at school board meetings and parent meetings.

* Support legislative efforts to require coursework in economics and personal finance for high school graduation. Let your state representatives and senators know through calls, letters or e-mails and personal contact.

* Write op-ed pieces highlighting the need for expanded financial education and offer them to local news media. Don’t overlook influential Internet bloggers…they can help spread the word quickly.

* Get behind or start financial and economic education programs in professional organizations and lend your skills. We ask a lot of our educators; they can do a lot, but they can’t do it all. We can all add our voices…and ourselves.

Concluding Comment

The current financial turmoil will take awhile to play itself out. The fundamentals of our economy remain strong, however, and 2008 looks to be a year of rising growth. Economic forecasters expect slow expansion in the first half of the year and a quickening pace in the second half. Meanwhile, if borrowers, lenders and investors can refocus on financial basics and re-emphasize critical lessons about credit and risk, the financial future can be brighter than the second half of 2007. For that brighter future, we need to infuse our education at all levels with the lessons of 2007—old lessons to be sure but easy to understand at a very practical level from 2007 experience. With continuing effort we can expect that financial upsets such as the current one will be infrequent and milder when they do occur.

Thank you and I’d be glad to take your questions.