Reflections on Four Decades in Central BankingJack GuynnPresident and Chief Executive OfficerFederal Reserve Bank of AtlantaKiwanis Club of AtlantaLoudermilk CenterAtlanta, Ga.August 22, 2006Thank you for the nice introduction. But let me say that it feels strange to hear you describe my upcoming retirement. I guess I’m still coping with the reality that my 42-year tenure at the Federal Reserve Bank of Atlanta is about to end.When I graduated from Virginia Tech back in the mid 1960s, I surprised my family and friends by taking a job with the Atlanta Fed. Before I left, some of my classmates responded with a gag gift: a green eyeshade, like one of those visors tellers used to wear in old movies like “It’s a Wonderful Life.”Many of my college friends were going into more glamorous fields such as aerospace or computer design. And in their minds, I was condemned to life in a stodgy, backwater industry. In that era it was thought you would choose one place to work and stay for your entire career.But, as it turned out, the financial services industry and the U.S. economy went through a revolution. Technology, competition, and a growing demand for information were catalysts for dramatic change. Certainly, this transformation made my career more interesting, and I expect even more change ahead.So, you might ask, “What’s the big deal?” Well, I believe that banking’s shift from a low-tech field without competition into a dynamic industry had a profound impact on our personal and business lives and is a major part of our nation’s economic success. In describing these changes today, I’d also like to point to some potential concerns for the next generation of policymakers.Changing how money is usedLet me begin by talking briefly about what bankers call their “back office operations”—the payment systems that most people take for granted. In the 1960s, if you peeked inside the Fed or most commercial banks, you would have seen endless bundles of checks and cash being counted and sorted by hand. As you can imagine, the process was inefficient.Often, it took three to five days or longer for a check to clear. During the high interest rate 1970s, folks would use this lag to their advantage through a practice we called “remote disbursement.”For instance, oil companies were notorious for writing big checks to pay for Gulf of Mexico oilfield leases, and they used checks drawn on small banks in remote places such as North Dakota. With interest rates at 15 percent, each day’s delay in payment for a $50 million check was worth about $20,000. So receivers of these large checks sometimes would buy a plane ticket for a courier to physically take the piece of paper across the country to speed collection.As more powerful technology became available we got busy and worked to improve the process. Not long after I started at the Fed, we realized that one computer-driven check sorter could do the work of 40 or 50 manual processors. Automated check processing became a classic application for emerging computer technology. Also, instead of relying solely on trucks, the Fed began to charter airplanes to carry checks long distances overnight.Computers that made check processing more efficient also enabled new electronic payment systems such as the automated clearinghouse, which facilitates transactions like direct deposit of payroll checks. During that period, credit cards also became more popular. With new methods of payment, the whiz kids of the banking industry began to think that a checkless—even a cashless—society was imminent.But it was not to be—at least not then. By speeding the collection of paper checks, the Fed may have delayed conversion to electronics. Also, regulations allowed banks to demand presentment of a paper check for payment, which also discouraged change. So many banks and their customers did not enthusiastically embrace new technology. In 2000 Americans were still writing 42 billion checks. And with the proliferation of automated teller machines, banks continued to circulate more—not less—cash.Finally, a few years ago, the volume of check payments began to decline about 4 percent per year—while electronic payments volume started to increase at double-digit rates. This transition continues as debit cards become more popular and businesses convert more and more check payments to electronic entries at the point of sale. You may have seen some of those new types of electronic conversions on your own bank statement.Looking ahead, I believe there will always be a market for cash and checks. But today’s kids who are now growing up on video games no doubt will prefer the convenience and speed of electronic payments. As money changes hands in new and faster ways, we face an evolving risk of fraud and identity theft. So consumers must be vigilant in managing their accounts. And financial institutions must ensure that their payment systems operate on a solid foundation of trust, which is at the heart of a strong financial system.The challenge of competition in bankingTechnology has changed not only payment, but also the whole financial system and U.S. economy. Just think of the impact of the Internet and the advance of cellular and digital communications. This recent progress has helped businesses to work more efficiently and allowed emerging economies around the world to develop more quickly than we ever imagined. Globalization, by the way, has lessened the cost of many imported goods and boosted demand for U.S.-produced goods and services.Along with technology, banking also has been transformed by competition. When I joined the Fed in the 1960s, banks were subject to rigid controls imposed by the states and Congress during the Great Depression. The idea was to maintain financial stability by restricting competition—both geographically and along product lines.There were strict limits on the interest banks could pay on savings deposits, and banks could not pay interest on transaction accounts. These restrictions were thought to prevent ruinous interest rate competition. The task of managing a bank balance sheet was largely a matter of following supervisory guidelines—green eye shade kind of work.Most states limited banks’ ability to branch outside their home county. And in some places branching was entirely prohibited. With near monopoly power in their respective neighborhoods, banks had little incentive to grow or innovate. Hence, the cliché about bankers’ hours of 3-6-3—take in money from savings accounts at 3 percent, lend it out at 6 percent, and hit the golf course by 3 o’clock.In the 1980s, with high and rising inflation, the old regulatory framework began to unravel. Investment banks posed an early threat to the banking deposit franchise with the introduction of money market accounts, which some of you may remember.To compete, banks issued large denomination certificates of deposit, which were not subject to interest rate ceilings, thus significantly increasing their costs. As restrictions on interest payments were lifted, more and more banks and thrifts got into trouble. We all remember the crisis in the savings and loan industry, which resulted in a bailout that was estimated to cost $175 billion.The most difficult year in banking was 1988 when more than 200 banks failed. Earlier in that decade, I led our bank’s supervision function. I remember setting up what we called “the war room” at the Atlanta Fed. This was a place to deal with the complex closure of a family of banks in Tennessee. In the final days of that crisis, we worked around the clock to find a buyer for the largest of these banks—unsuccessfully, it turned out. We ended up just closing the bank and hoping this failure wouldn’t lead to an old-fashioned bank panic.The number of bank failures declined in the 1990s and has stayed low. Meanwhile, Congress continued to reform the regulatory framework. In turn, we saw the rise of well-capitalized megabanks leveraging technology to cut costs and offering diverse and sometimes complex new products in competition with investment banks and insurance companies. Now, it’s often hard to tell the difference between banks and nonbanks.This competitive fray directly benefits today’s consumers and businesses, who enjoy lower-cost financial services, more choices and better access to capital. The growth of mutual funds has led to the rise of a new class of investors. Computers unleashed powerful innovations in credit scoring, and, with those new systems, some borrowers can qualify for a loan in minutes, if not seconds. Innovations in credit analysis and market segmentation have helped millions of Americans become homeowners.If you want to buy a car, you can still get an old-fashioned two-year loan, but today you can also choose to make payments over eight or even 10 years. Along with traditional fixed-rate mortgages, we now have adjustable rate mortgages, interest-only mortgages, reverse amortization mortgages, and more. And in today’s financial supermarket, we also can find home equity loans, mutual funds, hedge funds and countless other ways to borrow or invest. With advances in information technology and mathematical modeling, today’s financial markets are better than ever at allocating risk to those with the greatest appetite for it.Is all of this competition a good thing? All in all, I’d say the answer is yes. However, sometimes I fret about some of the implications of our global connectedness and the sheer size of some financial institutions and their new products. And I worry that some homeowners don’t really understand their new and not-yet-fully-tested mortgages.Overall, however, I believe our economy is much stronger and more resilient today because of the creative adjustments our financial sector has made in response to the sometimes painful challenges of competition.The economy in transitionWhat are the lessons of technology, innovation and competition for our economy? During the mid-1960s, one-third of the jobs in the United States were in manufacturing, and during the decades after World War II, there was not much global competition. Now, only one in nine U.S. jobs is in manufacturing, and most of the new factory jobs require technical skills. The fastest growing fields—financial services included—depend on knowledge, not physical labor.We’ve all heard the sometimes bitter debate on outsourcing and immigration. However, our ports and logistics facilities overflow with low-cost goods from overseas. Imports and exports—added up—are now equivalent to about one-fourth of gross domestic product. That figure 40 years ago was about 10 percent. Today’s economy is truly global.We’re all aware of our current preoccupation with lost jobs to other parts of the world, both in manufacturing and the services sector. But looking at the data, you’ll see three important facts. First, the majority of jobs lost involve relatively low-skilled, low-productivity work in fields like apparel production and call centers. Second, with respect to manufacturing, while it’s true there are fewer factory jobs as a proportion of total U.S. employment, the U.S. share of the value of world manufacturing output has remained stable, reflecting increases in worker productivity. Third, while it’s true that certain service-oriented jobs have moved to other countries, we still export more services to the rest of the world than we import from others.What’s the bottom line of these changes in our economy? The march of globalization is relentless, and businesses will have to keep spending more on technology to improve productivity. Technology allows consumers and businesses to compare prices from vendors around the world and find new and less expensive sources. And innovations in supply-chain management reduce the inventory swings that used to be commonplace in our economy, helping to dampen the contribution of inventory adjustments to economic cycles.Painful lessons in monetary policyGood economic outcomes depend on good monetary policy, where I’ve spent the past 10 years of my career. Recent experience in this area offers several other lessons.In the 1960s, economic growth was strong in part because of the fiscal stimulus of tax cuts and increased military and social spending. The Fed’s policy of leaning against inflationary pressures attracted little attention. But in the 1970s, policymakers tried to insulate the economy from relative price movements in one important commodity—oil. The big mistake in this policy was the failure to recognize that controlling inflation was a necessary first requirement for sustaining long-term growth.After the 1970s oil price shocks, it became fashionable to embrace the false notion that one could improve economic outcomes by trading a bit of inflation for growth. As we should now know, a bit of inflation can get out of hand quickly, especially when consumers and businesses expect more price increases, waste time and effort trying to beat inflation, and then rush to spend more money in a vicious inflationary cycle. The consequences of high inflation were and remain economically poisonous: increased uncertainty and risk, the added incentive to consume instead of invest, cost of living adjustments, and other marketplace distortions.During the early 1980s, Fed Chairman Paul Volcker and his Fed colleagues broke the back of high inflation by raising interest rates well into double digits. The costs were huge—both in economic and human terms. The U.S. economy endured two painful recessions. And along with the run-up in bank failures that I just mentioned, entire industries such as homebuilding collapsed. Because of our tough policy, the Fed was suddenly thrust into the public limelight.By 1996, when I became Atlanta Fed president and part of the Fed policymaking group, inflation expectations were, once again, under control. About that time, the federal budget deficits were reined in. With the fortuitous convergence of low inflation and rapid growth, we enjoyed the longest economic expansion in U.S. history. In hindsight, I may have been naïve, but I thought that Americans had truly learned the value of responsible fiscal and monetary policy working in tandem to foster economic growth for the long-term.The last decade, under the leadership of former Fed Chairman Alan Greenspan, also brought about major changes in how the Federal Reserve communicates our monetary policy actions and thinking. This transparency was and still is consistent with greater public scrutiny of the Fed and parallels the increase of financial information in the private sector that is central to today’s market-based approach to regulation.As amazing as it may sound today, until 1994, there was no announcement about the direction of monetary policy—not even after Federal Open Market Committee meetings. Market participants had to divine whether or not rates had changed by looking at conditions in money markets. This “quiet” (or silent) approach to communications gave rise to a cottage industry of “Fed watchers” who were devoted to interpreting our policy actions and likely policy direction.Now, after each FOMC meeting, we not only announce our action but also provide brief comments on the economy and potential risks to the outlook. For the last three years, we have even tried to signal the likely path of policy—in my view, an approach that’s worked well during this particular period.Our new Fed Chairman, Ben Bernanke, has talked about the need to make our policy goals even clearer. Minutes of our recent FOMC meetings indicate that the Fed is studying and debating the limits to what we should say about the outlook and possible future policy actions. My Fed colleagues and I have found that market reactions to our Fed comments can be surprising. And, in an environment of seemingly endless data reports, it’s sometimes hard in the short run to distinguish meaningful economic signals from noise.This thinking about transparency will evolve. And I expect the Fed will keep trying new and different ways to communicate important views and actions, including perhaps establishing targets for acceptable levels of inflation. Clearly, more central bank communications are helpful, but there is ample room to debate how to reflect the range of views and uncertainties that are inherent in the policymaking process.An interconnected worldWhile I’ve tried to make the case that our financial system and economy have gone through revolutionary changes in the past 40 years, I want to leave you with the notion that things will keep getting more complex and more interesting.From a payments perspective, our vision of an efficient, predominately electronic system is in sight. There will be fewer and bigger banks, and competition will keep altering our financial marketplace. We will all face more potential risks and rewards as the selection of financial products continues to multiply.Our financial system and our economy will continue to become more interconnected. Every moment of every day, vast sums of money zip around the world. Nine years ago a financial panic in Asia quickly led to financial market repercussions around the world. And with the emergence of China and India and increasing U.S. indebtedness, the global flow of funds will continue to grow, and our economy will depend more and more on events and decisions that occur outside our national borders.Monetary policymakers must continue to account for all of these changes and others we can’t envision as technology advances and shocks occur. We’ve been reminded over and over how adaptable and resilient our U.S. financial system and economy are, and no doubt we’ll be tested again. I’m leaving the FOMC confident in the Fed’s commitment to keep inflation at bay. I’m sure future policymakers will remember the lessons we learned in the past 40 years about what happens when you start down the slippery slope of trading inflation for growth.I wish my college buddies who gave me the green eye shade were here with us today. Contrary to what they might have expected, my experience as a central banker has been fascinating and, at times, downright exciting.For a long time, I’ve enjoyed an up close and personal view on banking and the economy, and pretty soon I’ll be watching from the bleachers. Looking ahead to the next four decades, I think we all have good reason to expect our financial system and our economy will remain strong and continue to be the envy of the rest of the world.

[관련키워드]

[뉴스핌 베스트 기사]

사진

사진

'왕사남' 900만 울린 '강가 포스터'

[서울=뉴스핌] 양진영 기자 = 2026년 최고 흥행작에 등극한 영화 '왕과 사는 남자'가 900만 관객 돌파를 기념해 짙은 여운을 남기는 강가 포스터를 공개했다.

'왕과 사는 남자'가 3일 900만 관객 돌파에 힘입어 강가 포스터를 공개했다. 영화 속 이홍위(박지훈)의 마지막과 함께 공개되는 장면 속 아련한 모습을 담아 깊은 울림을 전한다.

공개된 포스터는 왕위에서 쫓겨나 청령포로 유배된 이홍위가 강가에 홀로 앉아 쓸쓸히 물장난 치는 장면을 담았다. 흰색 도포를 입고 쪼그려 앉은 이홍위의 모습은 어린 나이에도 자유를 꿈꿨을 그의 심정을 짐작하게 해 먹먹한 감정을 자아낸다.

[사진=(주)쇼박스]

특히, 엄흥도 역의 유해진과 이홍위 역의 박지훈이 포스터 속 장면에 대해 직접 소회를 밝힌 바 있어 관객들의 감정을 배가시킨다. 유해진은 "이홍위가 유배지 강가에서 물장난 쳤던 모습이 기억에 남고, 그때 엄흥도의 심정은 아들을 바라보는 심정이 아니었을까? 유배지가 아니라면 자유롭게 있을 나이인데, 너무 안쓰러웠다"라 말하며, 해당 장면에 대한 남다른 애정을 언급하기도 했다.

박지훈 또한 "강가에 쪼그리고 앉아 있는 장면은 해진 선배님의 제안으로 생긴 장면. 생각해 보니 친구들과 뛰어놀고 싶을 시기, 유배지에 와서 혼자 물장난을 치며 무슨 생각을 했을까? 그런 단종의 마음을 표현하려고 노력했다" 며, 해당 장면의 비하인드 스토리와 함께 이홍위의 복합적인 내면을 표현하고자 고심했던 과정을 밝혀 눈길을 모았다.

이처럼 배우들은 물론 900만 관객의 마음을 뒤흔든 강가 포스터는 '비운의 왕'이라는 단종의 단편적 이미지에서 벗어나 '인간 이홍위'에 집중한 '왕과 사는 남자'만의 서사를 선명하게 드러낸다.

'왕과 사는 남자'는 1457년 청령포, 마을의 부흥을 위해 유배지를 자처한 촌장과 왕위에서 쫓겨나 유배된 어린 선왕의 이야기를 담은 영화다. 모두가 알고 있는 역사 속 숨겨진 단종의 이야기로 900만 관객의 마음속에 묵직한 감동을 남기며 파죽지세의 흥행을 기록 중이다.

jyyang@newspim.com

2026-03-03 08:11

사진

사진

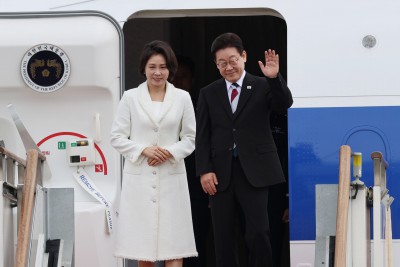

기획예산처 장관에 박홍근 지명

[서울=뉴스핌] 박찬제 기자 = 이재명 대통령이 2일 공석인 해양수산부 장관 후보자와 기획예산처 장관 후보자로 황종우 한국해사협력센터 국제협력위원장과 박홍근 더불어민주당 의원을 각각 지명했다.

이규연 청와대 홍보소통수석은 이날 오후 춘추관에서 브리핑을 열고 이 대통령이 이들을 포함해 정무직 장관급 4명, 헌법상 독립기구 2명, 대통령 소속 정부위원회 5명을 인선했다고 밝혔다.

이규연 청와대 홍보소통수석이 2일 청와대 춘추관에서 인선 브리핑을 하고 있다. [사진=KTV]

먼저 해수부 장관 후보자로 지명된 황 후보자는 해수부에서 기획조정실장을 비롯한 핵심 보직을 두루 거친 정통 관료다. 이 수석은 "부산 출신인 황 후보자는 북극항로 시대를 주도하고 해양수도 완성을 차질없이 추진해 나갈 적임자"라고 설명했다.

기획예산처 장관 후보자인 박 의원은 4선 국회의원으로, 국회 예산결산특별위원장, 운영위원장 등 중요 상임위원장 자리를 두루 맡아본 '국가 예산 정책 전문가'로 꼽힌다. 이 수석은 "아울러 이재명정부 국정기획위원회 기획분과위원장을 맡았던 박 후보자는 국민주권정부의 예산을 이끌 적임자"라고 인사 이유를 설명했다.

국가권익위원장에는 정일연 변호사가 임명됐다. 판사 출신으로 수원지법 안산지원장과 서울중앙지법 부장판사를 두루 거친 정통 법조인이다. 이 수석은 "권익위를 조속히 정상화하고 국민들의 고충을 해소하며 부정부패 없는 사회를 구현해 나갈 적임자"라고 강조했다.

진실화해를위한과거사정리위원회 위원장에 송상교 전 진화위 사무처장이 임명됐다. 대한변호사협회 인권위원과 검찰 과거사위원을 지낸 법조인 출신인 송 신임 위원장은 국가 폭력과 인권 침해를 규명하기 위해 새로 출범하는 3기 진화위를 정상화시킬 적임자라고 이 수석은 인선 배경을 밝혔다.

중앙선관위 위원 후보자로 윤광일 숙명여대 정치외교학과 교수와 전현정 변호사가 각각 지명됐다. 윤 교수는 선거제도 개혁방안을 연구해온 전문가로 공정한 선거관리와 선거제도 개혁을 이끌 적임자로 주목 받는다. 전 변호사는 서울 중앙지법 부장판사 등 20년 넘게 법복을 입은 법률가다. 민주주의 근간인 선거관리에 신뢰 높일 적임자라고 이 수석은 소개했다.

총리급인 규제합리화위원회 부위원장에 남궁범 에스원 고문과 박용진 전 민주당 의원, 이병태 KAIST 명예교수가 각각 임명됐다. 남궁 부위원장은 삼성전자에서 30년 이상 근무하고 보안전문업체 대표이사를 역임한 경영과 재무 전문가다.

박 전 의원은 민주당에서 정책위원회 부의장과 원내부대표를 지냈고 불합리한 규제를 발굴하고 규제개선을 추진해왔다. 이 명예교수는 기술 창업과 정보통기술(IT) 경영전략 다양한 분야에서 학술·사회 활동을 이어온 전문가로 규제개혁을 이끌 적임자라고 인선 이유를 설명했다.

기본사회위원회 부위원장에 강남훈 한신대 명예교수가 임명됐다. 이 수석은 "경제 기본권과 사회 형평성 연구해온 기본사회 정책방향을 설계할 적임자"라고 소개했다.

국가생명윤리 심의위원회 위원장에는 김옥주 서울대 의대 주임교수가 임명됐다. 이 수석은 "한국생명윤리학회자, 대한의학회장 등 거친 생명윤리에 관한 정책방향 제시할 적임자"라고 했다.

이 수석은 정일연 후보의 경우 이 대통령과 연관된 쌍방울 대북송금사건 변호인에 이름을 올린 바 있다. 이에 대해 이 수석은 "검증과정에서 확인은 했다"면서도 "20년동안 법관으로 재직을 했고, 귄익위원장 자리에서 보면 공정성, 독립성을 훼손할만한 부분은 없었다. 오히려 전문성과 도덕성 갖췄다고 판단했다"고 논란을 일축했다.

이 수석은 통합 인선 여부에 대한 언론 질의에 "이재명정부의 통합 실용인사 방향은 계속 될 것"이라면서도 "전체적인 인사의 방향에서 그런 실용과 통합 노선은 갖고 가지만, 특정한 자리를 놓고 여기는 이런 사람을 써야 된다는 것은 아니다"고 했다.

pcjay@newspim.com

2026-03-02 16:01